- #Turbotax review of 2017 filing for free

- #Turbotax review of 2017 filing software

- #Turbotax review of 2017 filing professional

- #Turbotax review of 2017 filing free

The advantage of the TaxAct approach is that it lets you keep moving through your filing with the information you have you can come back and fill in the missing data later. TurboTax does not allow users to advance without entering Social Security numbers, tax IDs, etc. With TaxAct, you can proceed from screen to screen even if you haven't filled in all the required information. On the other hand, if you are less sure of your tax prowess, TaxAct might not provide enough guidance for you. You can probably finish your taxes more quickly in TaxAct than in TurboTax. For example, suppose you are an experienced DIY filer who is reasonably confident about online tax prep and you have your documents in order. TaxAct's simplicity is a strength or a weakness, depending on your perspective. It includes a straightforward path through tax preparation, asking enough questions to guide you without getting chatty. The app has fewer bouncing and moving visual elements, which can help those of us who tend to get distracted. TaxAct is a no-nonsense DIY tax preparation app. W-2 income unemployment income retirement distributions tuition and fees deduction earned income tax credit child tax credit

#Turbotax review of 2017 filing professional

Option to have a professional file your taxes at an additional cost.Good middle-of-the road option on price and efficiency.Free, instant access to a tax expert at all plan levels.

#Turbotax review of 2017 filing free

4 plans, including a free federal option.It's best for someone who appreciates a simple, streamlined interface. TaxAct gets the job done with fewer bells and whistles than H&R Block or TurboTax, though costs can still add up. In addition, the number and detail of the questions that TurboTax requires users to answer can be a bit tedious, particularly if you have to click through numerous screens that don't apply to you.īut generally, TurboTax creates a thorough and supportive DIY tax-filing experience that can help even first-time taxpayers file with confidence. At times, it may feel a bit like swatting flies. I find the number of upselling ads irritating. There are downsides to TurboTax, however.

If you want to throw up your hands halfway through your DIY filing, you can turn over the whole mess to a pro. TurboTax offers an option to have a professional do your taxes for you. If you feel uncertain about DIY tax preparation, the TurboTax experience will calm your fears.

#Turbotax review of 2017 filing software

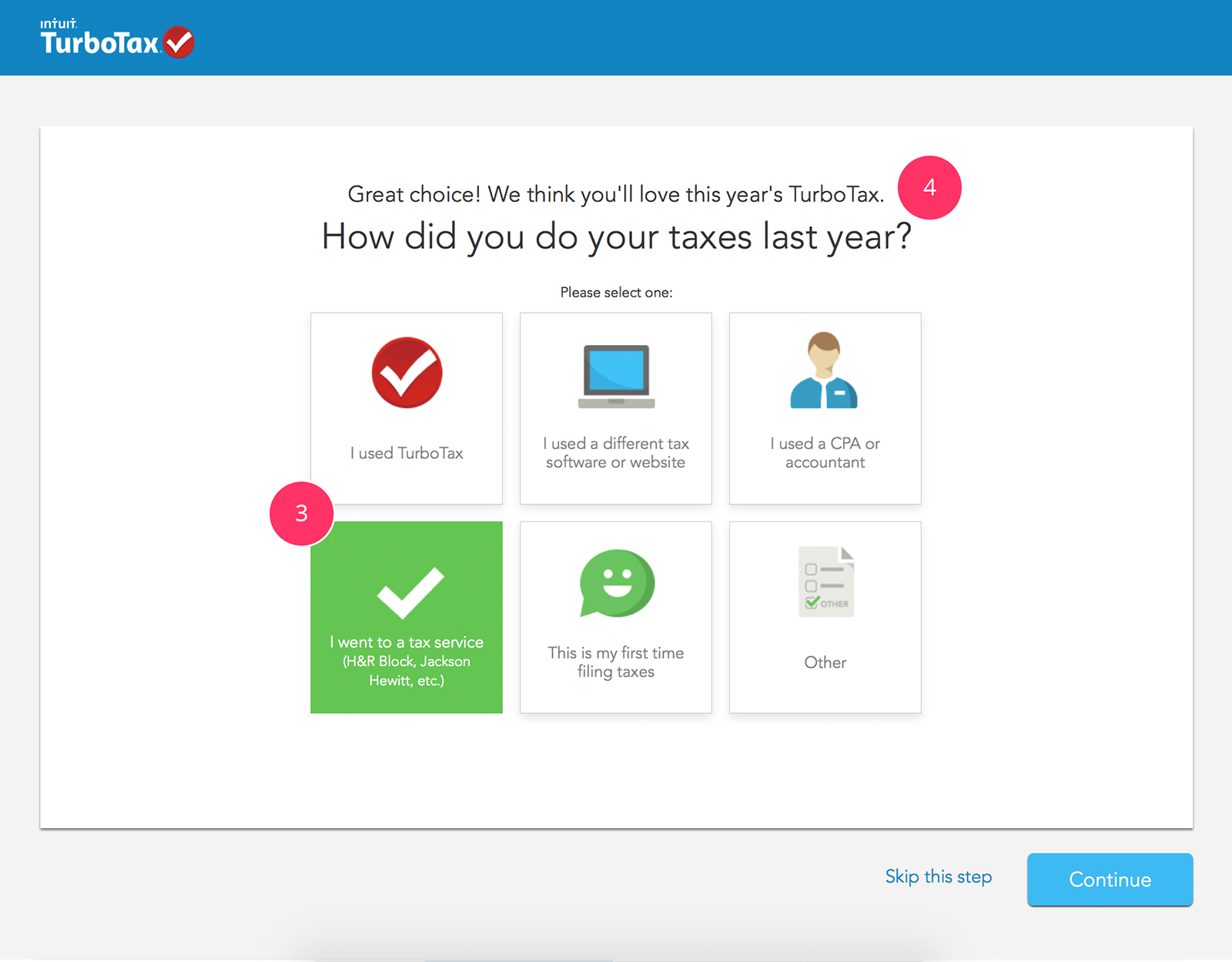

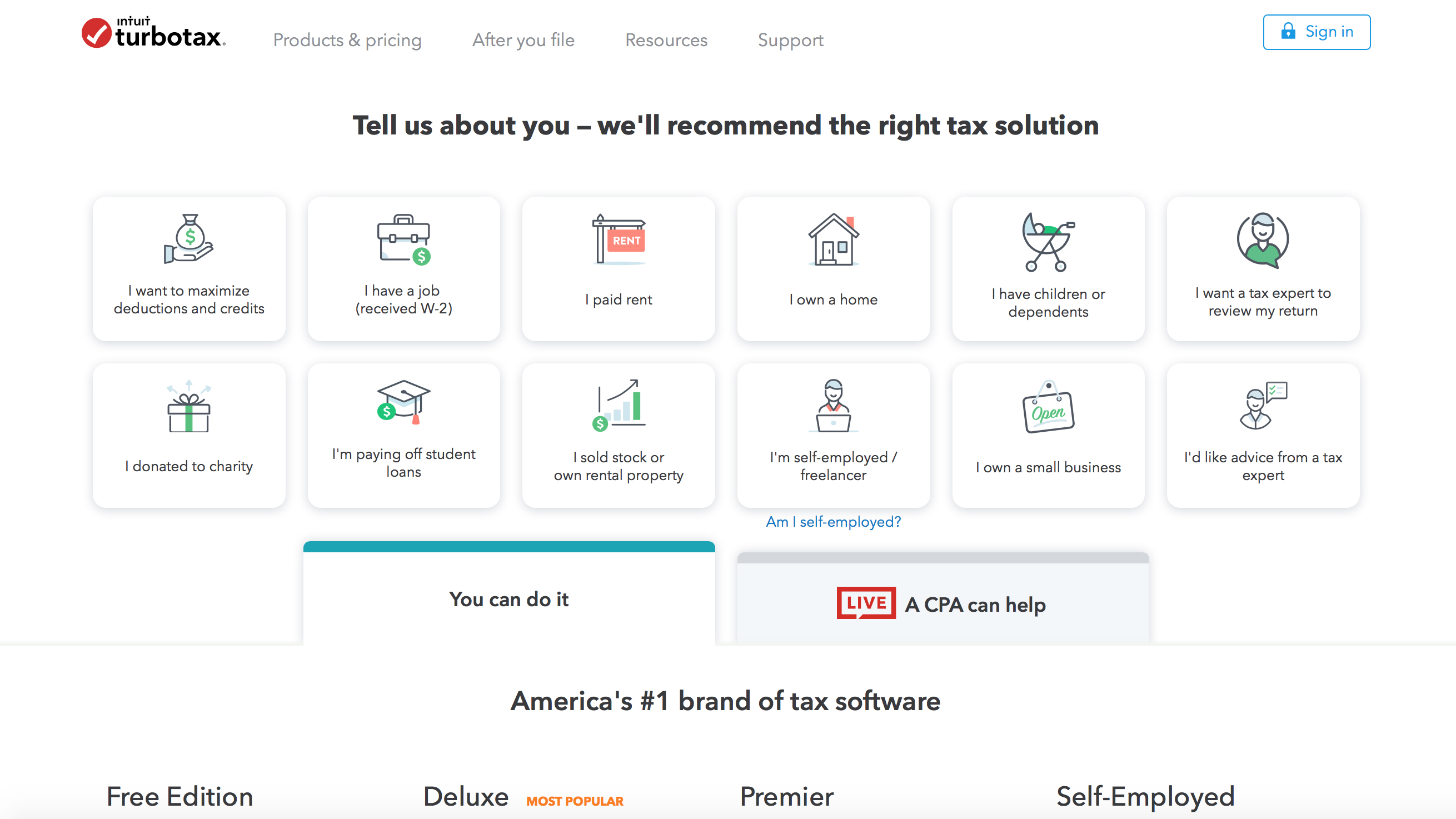

One of the biggest benefits of TurboTax is that the software walks you through a wide range of possible income and deductions so you don't miss anything. TurboTax will suggest which package is best for you (including the free simple tax returns edition) based on your selections. The home screen presents you with a set of income and deduction choices, as well as priorities and goals. The software gently pulls you forward with friendly, conversational messages that break down tax issues into easy-to-understand language. TurboTax has a highly interactive user experience. W-2 income unemployment income retirement distributions interest and dividend income earned income tax credit child tax credit Upgradeable for instant access to a tax expert.Completely free option for simple tax situations at any income level (not all tax payers qualify).It's especially valuable for self-employed filers who use QuickBooks integration. TurboTax is among the most expensive options for filing taxes online, but offers a high-quality user interface and access to experts. You can check the company's website to see current offers. The prices listed in this article do not include discounts.

Note: Tax prep companies frequently offer discounts on products early in the season.

#Turbotax review of 2017 filing for free

Qualify for free filing on simple tax returns returns (not all taxpayers qualify).Which software will cost you less will depend on the types of income and deductions you have to report. While TaxAct promotes itself as a cheaper alternative to TurboTax, that isn't always the case. Options to uploadi tax documents and previous returns, and import data from other tax software.Expert assistance for an additional fee.A running total of your estimated refund or tax due displayed at the top of every page.Prompts and questions to help you find and input your numbers.TurboTax and TaxAct share many helpful features. TaxAct is a good choice if you are confident in your ability to do your taxes and you want to breeze through without a lot of fuss. TurboTax can help you find all your deductions, especially if your tax picture is complex.

0 kommentar(er)

0 kommentar(er)